Real estate NOI is one of the most important factors for both purchasing a property and developing its budget. Property taxes for real estate buildings are for the cost of land and anything permanently affixed to the land. Income tax is deducted from the property’s gross income in a fiscal year. NOI is calculated before income tax deductions, but it does include property taxes. Also, factors like rental income and maintenance costs can fluctuate throughout the fiscal year. It’s important to note that your building’s NOI will vary from the example above and will depend on how your property operates. Since NOI is usually calculated annually, simply multiply $28,000 by 12 to get the annual NOI of $336,000. Imagine the information below is the monthly revenue and expenses of a multifamily property. To help apply the formula in real life, let’s go over an example. Net Operating Income = RR - OE, where RR is real estate revenue, and OE is operating expenses.

Noi calculation commercial real estate upgrade#

However, one-time capital expenditures (CapEx) - money used to maintain or upgrade physical assets - are not included in the calculation.

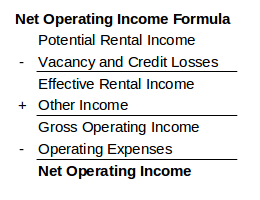

They may include insurance, utilities, salaries for staff, repairs, etc. While property expenses can vary according to the building’s type, age, and size, all properties have ongoing costs associated with running and maintaining them. NOI = Gross operating income – operating expensesĪ property’s gross operating income includes revenue from: In general, real estate NOI is calculated by subtracting the property’s operating expenses from the income that it produces. Net operating income is a valuation method that real estate professionals use to determine the value and profitability of an income-generating property. In addition, we’ll discuss why investing in property technology (proptech) is one of the best ways to increase your property’s NOI.

Noi calculation commercial real estate how to#

Read on to better understand NOI, why it’s so important, and how to maximize it. And if you’ve been in this industry for long, you know how much real estate NOI matters when it comes to investing in or managing properties. As a real estate professional, you’ve probably heard the term NOI (net operating income) being tossed around a lot in conversations.

0 kommentar(er)

0 kommentar(er)